Transactions: Your Financial Ledger

The Transactions section provides a comprehensive log of all financial activity in your café, serving as your digital accounting ledger with real-time updates and powerful filtering capabilities.

Transaction Overview

Every financial movement is recorded, including:

- GamePass purchases

- F&B sales

- Wallet recharges

- Play Lab rentals

- Refunds and adjustments

- Deposit collections

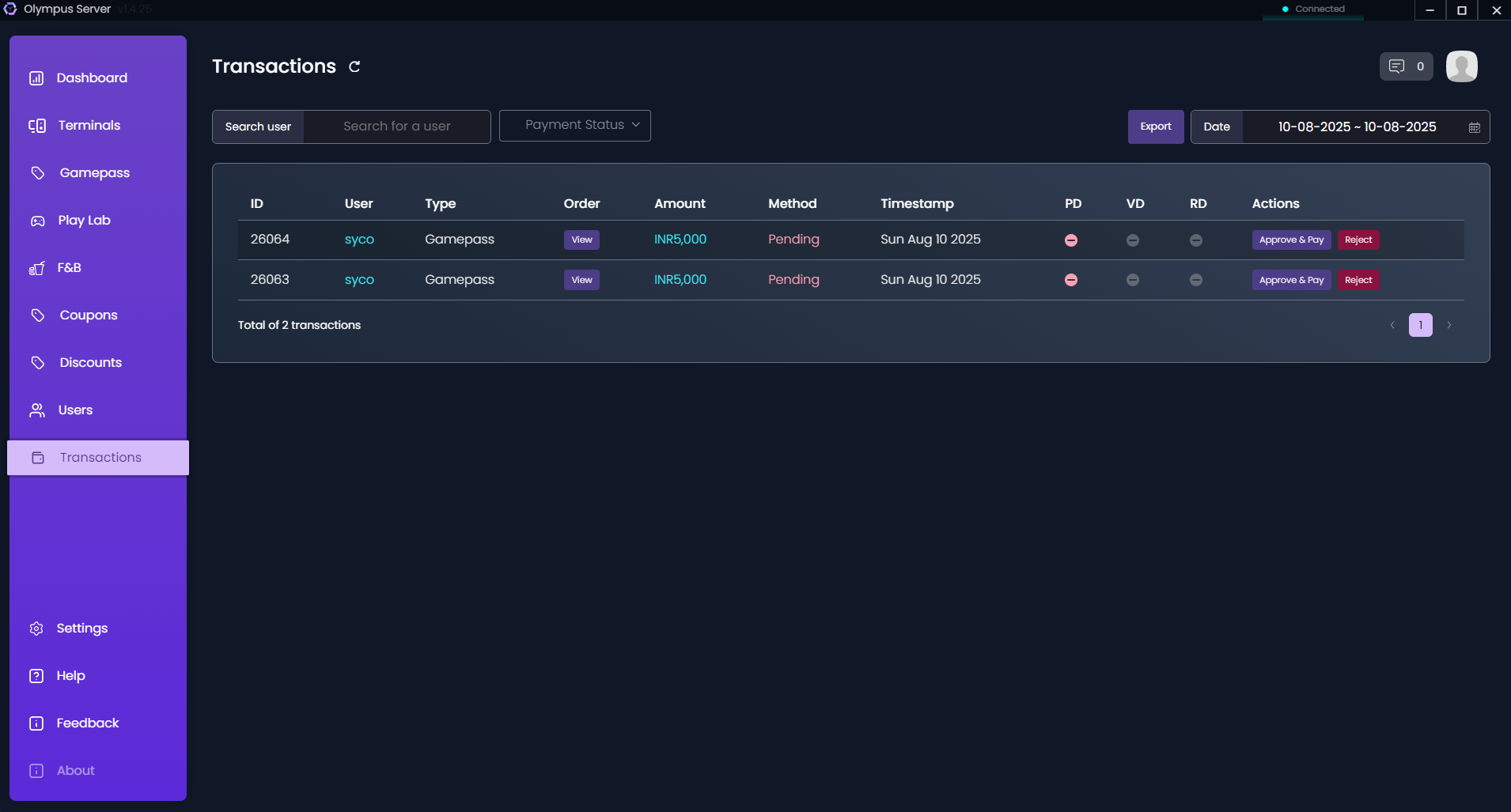

Viewing Transactions

Default View

The transaction list displays:

- Transaction ID: Unique reference number

- Date & Time: When the transaction occurred

- User: Customer name and ID

- Type: Category of transaction

- Description: Details of the purchase

- Amount: Transaction value

- Payment Method: How payment was received

- Status: Completed, Pending, or Failed

- Staff: Employee who processed the transaction

Filtering Options

By Date Range

- Today's transactions

- Yesterday's activity

- This week/month

- Custom date range

- Specific date selection

By Transaction Type

- Sales: All revenue transactions

- Recharges: Wallet top-ups

- Refunds: Money returned to customers

- Adjustments: Manual corrections

- Deposits: Security deposits collected

By Payment Method

- Cash

- Credit/Debit Card

- UPI/Digital Wallets

- Bank Transfer

- Wallet Balance

- Promotional Credits

By Status

- Completed: Successfully processed

- Pending: Awaiting confirmation

- Failed: Transaction unsuccessful

- Reversed: Refunded transactions

By User or Staff

- Search specific customer transactions

- Filter by staff member

- View walk-in customer sales

Transaction Details

Click any transaction to view:

Complete Information

- Full transaction breakdown

- Item-wise details

- Tax calculations

- Discount applications

- Payment reference numbers

Related Actions

- Print receipt

- Email invoice

- Process refund

- Add notes

- View user profile

Financial Reports

Daily Reports

Cash Register Summary:

- Opening balance

- Total cash received

- Total cash paid out

- Closing balance

- Denomination breakdown

Sales Summary:

- Total revenue

- Transaction count

- Average transaction value

- Payment method distribution

- Category-wise breakdown

Periodic Reports

Weekly/Monthly Analysis:

- Revenue trends

- Growth comparisons

- Peak business periods

- Popular services

- Payment preferences

Tax Reports:

- GST collection summary

- Tax liability calculation

- Input tax credit

- Filing-ready reports

Reconciliation Features

Daily Closing

- Count Physical Cash: Record actual cash in register

- System Calculation: Compare with system records

- Identify Discrepancies: Find any mismatches

- Document Reasons: Note explanation for differences

- Approve Closing: Supervisor verification

Bank Reconciliation

Match your records with bank statements:

- Import bank statements

- Auto-match transactions

- Flag discrepancies

- Track pending deposits

- Monitor settlement times

Refund Management

Processing Refunds

- Locate original transaction

- Click "Refund" button

- Select refund type:

- Full refund

- Partial refund

- Store credit

- Enter reason for refund

- Choose refund method

- Process with approval

Refund Policies

Configure automated rules:

- Time limits for refunds

- Approval requirements

- Refund methods allowed

- Documentation needed

Export & Integration

Export Options

Download transaction data as:

- Excel (.xlsx): For spreadsheet analysis

- CSV: For database import

- PDF: For printing and filing

- JSON: For API integration

Accounting Integration

Connect with accounting software:

- Tally export format

- QuickBooks compatibility

- Custom API endpoints

- Automated daily exports

Audit Trail

Transaction History

Every transaction maintains:

- Creation timestamp

- Modification history

- User actions log

- Status changes

- Note additions

Security Features

- Immutable Records: Transactions cannot be deleted

- Edit Tracking: All modifications logged

- Access Control: Role-based permissions

- Digital Signatures: For high-value transactions

Analytics Dashboard

Key Metrics

Revenue Analytics:

- Hourly revenue distribution

- Day-wise patterns

- Service-wise contribution

- Growth trends

Payment Analytics:

- Method preferences

- Transaction success rates

- Average processing time

- Failed transaction analysis

Customer Analytics:

- Spending patterns

- Frequency analysis

- Lifetime value

- Churn indicators

Best Practices

Daily Operations

- Regular Reconciliation: Close cash register daily

- Receipt Management: Always offer receipts

- Documentation: Note unusual transactions

- Backup Records: Regular data backups

Month-End Procedures

- Complete Reconciliation: Match all pending transactions

- Generate Reports: Prepare monthly summaries

- Tax Filing: Calculate tax obligations

- Archive Records: Store transaction backups

Fraud Prevention

- Dual Approval: For high-value transactions

- Regular Audits: Random transaction checks

- Access Logs: Monitor who accesses financial data

- Alert Systems: Unusual pattern notifications

Troubleshooting

Common Issues

Missing Transactions:

- Check filter settings

- Verify date range

- Review pending status

- Check user permissions

Reconciliation Mismatches:

- Review refunds processed

- Check manual adjustments

- Verify cash deposits

- Examine failed transactions

Report Discrepancies:

- Ensure correct date range

- Verify filter criteria

- Check timezone settings

- Review calculation methods